5 Ways to Choose Utah Health Insurance

Utah Health Insurance: Making the Right Choice

Choosing the right health insurance plan can be a daunting task, especially with the numerous options available in Utah. With the ever-changing healthcare landscape, it’s essential to make an informed decision that meets your needs and budget. Here are five ways to help you choose the best Utah health insurance plan for you and your family.

1. Assess Your Needs

Before selecting a health insurance plan, take some time to assess your needs. Consider the following factors:

- Age and health status: If you’re older or have pre-existing health conditions, you may want to opt for a plan with more comprehensive coverage.

- Family size and dynamics: If you have a large family or dependents, you’ll want to choose a plan that covers everyone’s needs.

- Lifestyle and habits: If you’re an avid smoker or enjoy extreme sports, you may want to consider a plan with additional coverage for related health issues.

- Prescription medication: If you take prescription medication regularly, look for a plan with a robust pharmacy network and affordable copays.

2. Understand the Types of Plans

Utah health insurance plans come in various types, including:

- HMO (Health Maintenance Organization): These plans typically have lower premiums but require you to see in-network providers.

- PPO (Preferred Provider Organization): These plans offer more flexibility in choosing providers but often come with higher premiums.

- EPO (Exclusive Provider Organization): These plans are similar to HMOs but may offer more flexibility in certain situations.

- Catastrophic plans: These plans have lower premiums but higher deductibles and are only available to individuals under 30 or those who qualify for a hardship exemption.

3. Evaluate the Network

When choosing a health insurance plan, it’s essential to evaluate the network of providers. Consider the following:

- In-network providers: Check if your primary care physician and specialists are part of the plan’s network.

- Out-of-network providers: Understand the costs and coverage for seeing out-of-network providers.

- Hospital and facility network: Ensure the plan’s network includes hospitals and facilities that meet your needs.

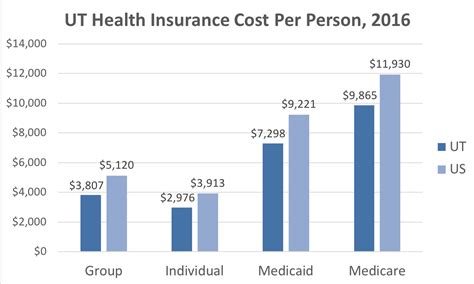

4. Compare Costs

Utah health insurance plans can vary significantly in cost. Consider the following:

- Premiums: Calculate your monthly premiums and ensure they fit within your budget.

- Deductibles: Understand the deductible amounts and how they apply to your plan.

- Copays and coinsurance: Compare the copays and coinsurance rates for doctor visits, prescriptions, and other services.

- Maximum out-of-pocket (MOOP): Calculate the maximum amount you’ll pay annually for healthcare expenses.

| Plan Type | Premiums | Deductibles | Copays | MOOP |

|---|---|---|---|---|

| HMO | $300/month | $1,000/year | $20/doctor visit | $7,000/year |

| PPO | $500/month | $2,000/year | $50/doctor visit | $10,000/year |

| EPO | $400/month | $1,500/year | $30/doctor visit | $8,000/year |

5. Check for Additional Benefits

Some Utah health insurance plans offer additional benefits, such as:

- Dental and vision coverage: Check if the plan includes coverage for dental and vision care.

- Gym membership discounts: Some plans offer discounts on gym memberships or fitness programs.

- Wellness programs: Look for plans that offer wellness programs, such as disease management or nutrition counseling.

📝 Note: Always review the plan's documentation and ask questions before enrolling to ensure you understand the benefits and limitations.

As you navigate the Utah health insurance market, remember to prioritize your needs, evaluate the network, compare costs, and check for additional benefits. By following these steps, you’ll be well on your way to choosing the best health insurance plan for you and your family.

What is the difference between an HMO and a PPO?

+

An HMO typically requires you to see in-network providers, while a PPO offers more flexibility in choosing providers but often comes with higher premiums.

Can I change my health insurance plan during the year?

+

Typically, you can only change your health insurance plan during the annual open enrollment period or if you experience a qualifying life event, such as getting married or having a child.

How do I apply for Utah health insurance?

+

You can apply for Utah health insurance through the state’s health insurance marketplace or directly through an insurance company.

Related Terms:

- Utah health insurance Marketplace

- utah health insurance buka sekarang

- University of Utah Health Insurance

- Utah health insurance cost

- utah health insurance rating tertinggi

- Best health insurance in Utah