5 Ways to Thrive with High Deductible Health Plans

Understanding High Deductible Health Plans (HDHPs)

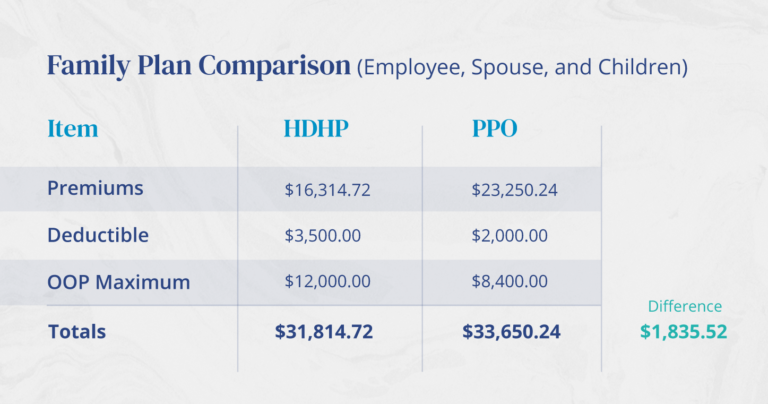

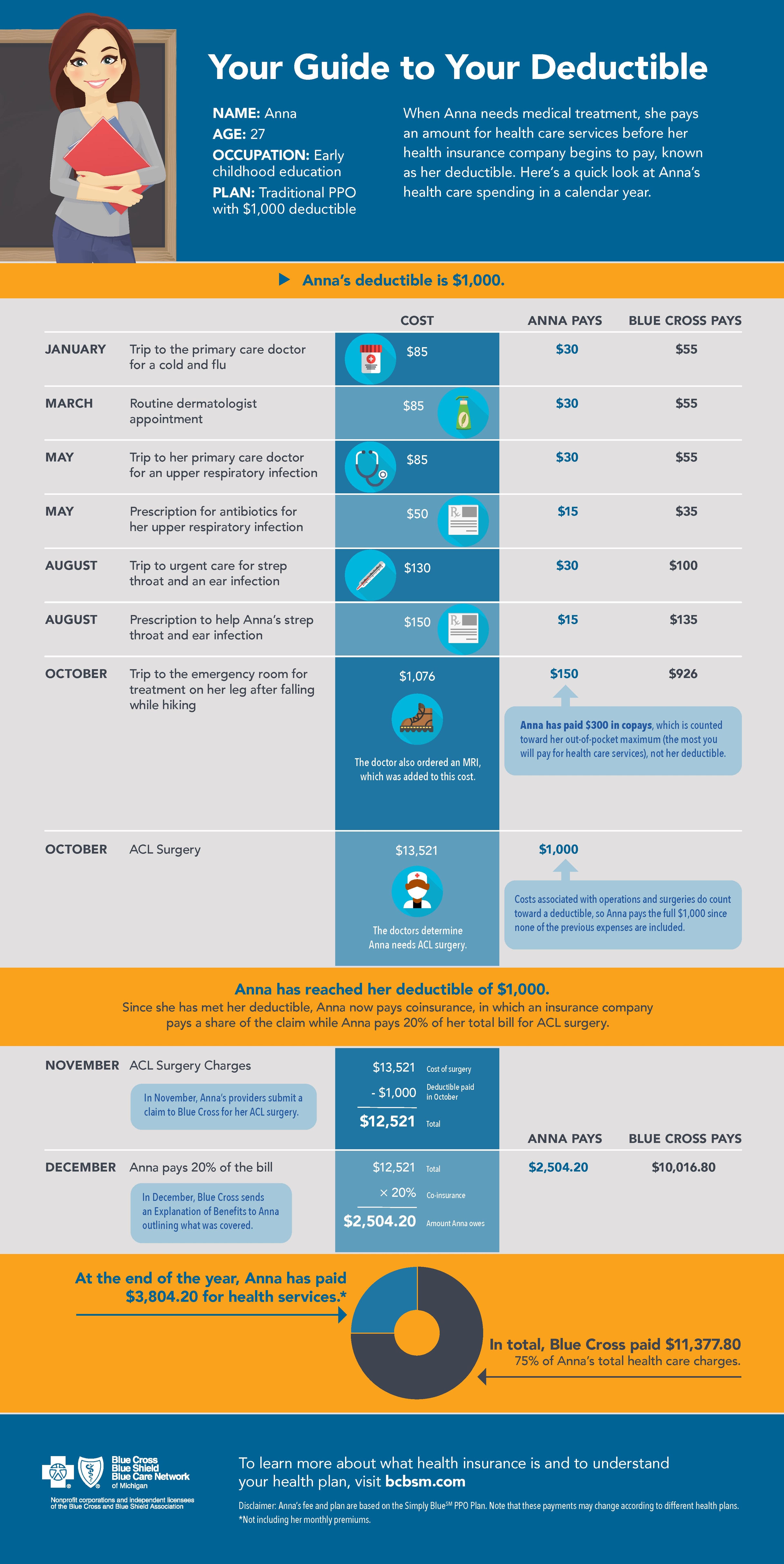

High deductible health plans (HDHPs) have become increasingly popular in recent years due to their lower premiums. However, these plans often come with higher out-of-pocket costs, which can be challenging for individuals and families to manage. The key to thriving with HDHPs is to understand how they work and to develop strategies to minimize their financial impact.

1. Know Your Plan Inside Out

To navigate an HDHP successfully, it’s essential to understand its specifics. Here are some crucial aspects to consider:

- Deductible: The amount you must pay out-of-pocket before your insurance coverage kicks in.

- Coinsurance: The percentage of medical expenses you’ll pay after meeting your deductible.

- Copays: The fixed amount you’ll pay for specific services, such as doctor visits or prescriptions.

- Out-of-pocket maximum: The maximum amount you’ll pay annually for healthcare expenses.

Take the time to review your plan’s details, and ask your insurance provider if you have any questions or concerns.

2. Build an Emergency Fund

HDHPs often come with higher deductibles, which can be a significant financial burden. Having a dedicated emergency fund can help you cover unexpected medical expenses. Aim to save 3-6 months’ worth of living expenses in a separate, easily accessible savings account.

Consider the following tips to build your emergency fund:

- Set up automatic transfers from your checking account.

- Take advantage of tax-advantaged savings options, such as a Health Savings Account (HSA).

- Review and adjust your budget to allocate more funds towards your emergency fund.

3. Utilize Preventive Care Services

Preventive care services, such as annual check-ups and screenings, are often covered by HDHPs without requiring a deductible. Take advantage of these services to stay healthy and avoid costly medical issues down the line.

Some examples of preventive care services include:

- Annual physicals

- Vaccinations

- Cancer screenings

- Mental health screenings

4. Leverage Health Savings Accounts (HSAs)

If you have an HDHP, you may be eligible for a Health Savings Account (HSA). HSAs allow you to set aside pre-tax dollars for medical expenses, which can help reduce your taxable income.

Here are some benefits of using an HSA:

- Contributions are tax-deductible

- Earnings grow tax-free

- Withdrawals for qualified medical expenses are tax-free

👍 Note: HSAs are only available to individuals with HDHPs and have specific eligibility requirements. Consult with a financial advisor or tax professional to determine if an HSA is right for you.

5. Negotiate Medical Bills

If you receive a large medical bill, don’t assume you have to pay the full amount. Negotiating with your healthcare provider or billing department can help reduce your expenses.

Here are some tips for negotiating medical bills:

- Ask about available discounts or financial assistance programs

- Request a detailed breakdown of charges to identify potential errors

- Be respectful and persistent in your negotiations

What is a high deductible health plan (HDHP)?

+

A high deductible health plan (HDHP) is a type of health insurance plan that has a higher deductible compared to traditional plans. HDHPs often have lower premiums, but require you to pay more out-of-pocket for medical expenses.

Can I use a Health Savings Account (HSA) with any health insurance plan?

+

No, HSAs are only available to individuals with high deductible health plans (HDHPs) that meet specific eligibility requirements. Consult with a financial advisor or tax professional to determine if an HSA is right for you.

How can I reduce my medical expenses with an HDHP?

+

There are several ways to reduce your medical expenses with an HDHP, including building an emergency fund, utilizing preventive care services, leveraging HSAs, and negotiating medical bills. By taking these steps, you can minimize the financial impact of an HDHP.

By understanding how HDHPs work and implementing these strategies, you can thrive with your high deductible health plan and maintain your financial well-being.