Cigna Global Health Insurance: Cost and Benefits Explained

Cigna Global Health Insurance: Cost and Benefits Explained

As the world becomes increasingly interconnected, the need for comprehensive global health insurance has never been more pressing. For individuals and families who live, work, or travel abroad, accessing quality healthcare can be a daunting task. This is where Cigna Global Health Insurance comes in – a leading international health insurance provider that offers a range of plans to suit diverse needs. In this article, we will delve into the cost and benefits of Cigna Global Health Insurance, helping you make an informed decision about your health coverage.

Who is Cigna Global Health Insurance For?

Cigna Global Health Insurance is designed for individuals and families who require comprehensive health coverage while living, working, or traveling abroad. This includes:

- Expats and digital nomads

- International students

- Travelers and adventure-seekers

- Global corporations and employees

- Individuals with dual residences or frequent travelers

Benefits of Cigna Global Health Insurance

Cigna Global Health Insurance offers a wide range of benefits, including:

- Comprehensive medical coverage: Access to quality medical care worldwide, including hospital stays, surgeries, and outpatient treatments.

- Flexible plan options: Choose from a range of plans to suit your needs, including bronze, silver, gold, and platinum options.

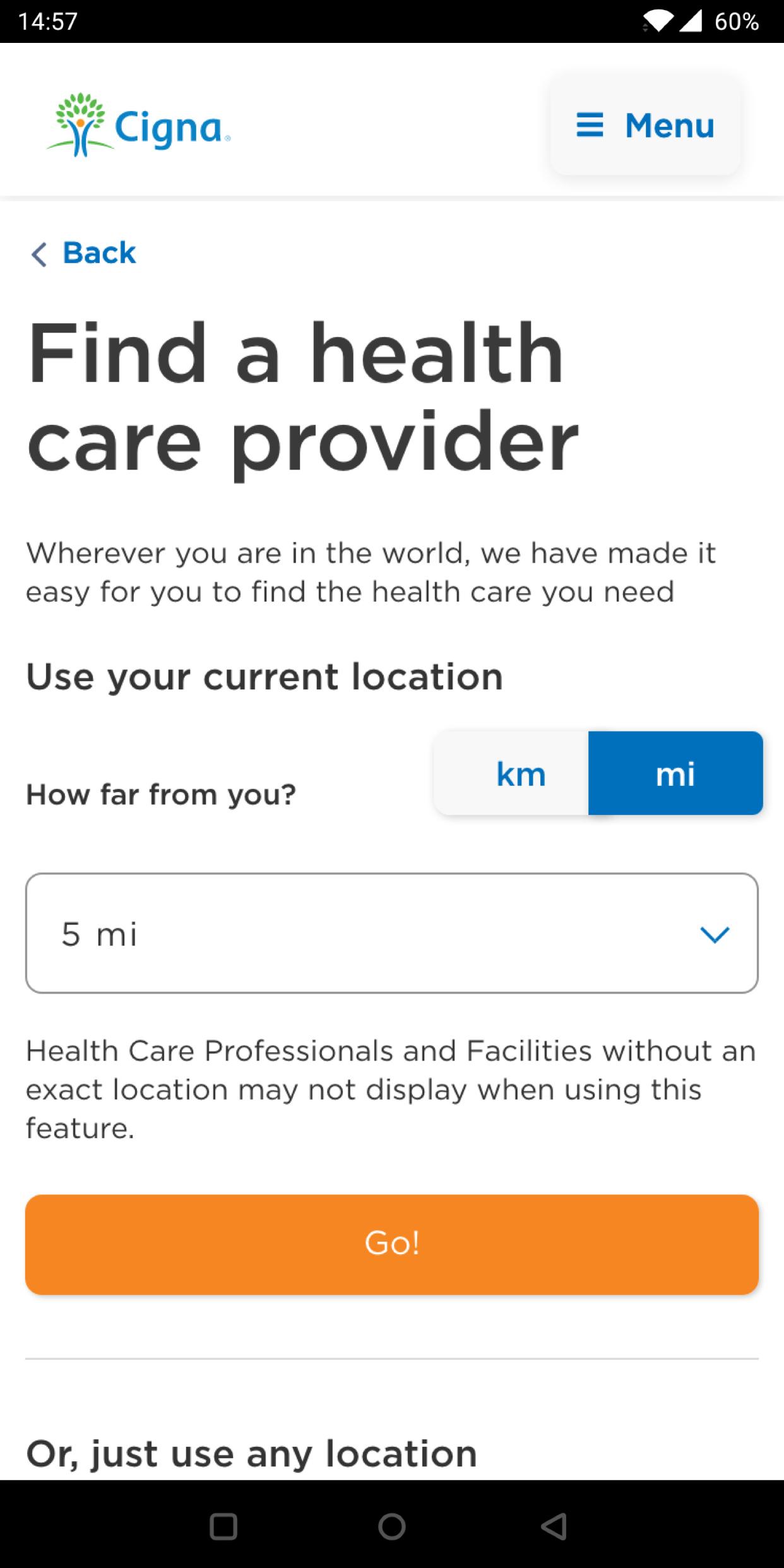

- Global network: Access to Cigna’s extensive network of healthcare providers worldwide.

- 24⁄7 customer support: Dedicated customer support team available to assist with claims, questions, and concerns.

- Pre-existing condition coverage: Some plans offer coverage for pre-existing medical conditions.

- Maternity and newborn care: Coverage for pregnancy-related care and newborn expenses.

Cost of Cigna Global Health Insurance

The cost of Cigna Global Health Insurance varies depending on several factors, including:

- Age: Premiums increase with age.

- Location: Premiums vary depending on the country or region you reside in.

- Plan selection: More comprehensive plans cost more.

- Deductible and co-pay: Higher deductibles and co-pays can lower premiums.

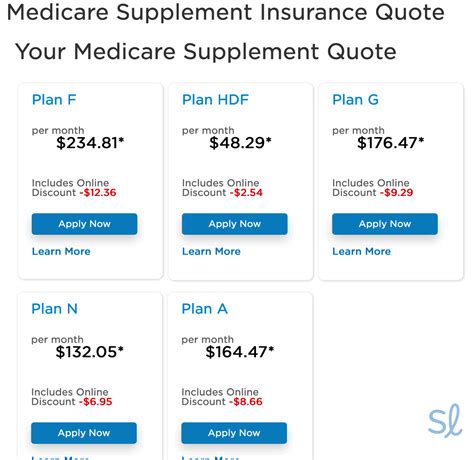

Here is a rough estimate of Cigna Global Health Insurance premiums:

| Age | Bronze Plan | Silver Plan | Gold Plan | Platinum Plan |

|---|---|---|---|---|

| 20-29 | $150-300/month | $250-500/month | $400-800/month | $800-1,200/month |

| 30-39 | $200-400/month | $350-700/month | $550-1,100/month | $1,200-1,800/month |

| 40-49 | $300-600/month | $500-1,000/month | $800-1,600/month | $1,800-2,500/month |

| 50-59 | $500-1,000/month | $800-1,600/month | $1,200-2,400/month | $2,500-3,500/month |

Please note that these are rough estimates, and actual premiums may vary.

Plan Options

Cigna Global Health Insurance offers four main plan options:

- Bronze: Basic coverage for essential medical expenses.

- Silver: Mid-level coverage for moderate medical expenses.

- Gold: Comprehensive coverage for major medical expenses.

- Platinum: High-end coverage for extensive medical expenses.

Each plan option has varying levels of coverage, deductibles, and co-pays.

👉 Note: Premiums and plan details may vary depending on your location and individual circumstances.

Claims and Reimbursement Process

Cigna Global Health Insurance has a straightforward claims and reimbursement process:

- Submit a claim: Notify Cigna of your medical expenses.

- Provide documentation: Submit supporting documents, such as medical bills and receipts.

- Reimbursement: Cigna reviews and reimburses eligible expenses.

Global Network and Healthcare Providers

Cigna Global Health Insurance has an extensive network of healthcare providers worldwide, including:

- Hospitals: Access to quality hospitals and medical facilities.

- Doctors and specialists: Network of doctors and specialists in various fields.

- Pharmacies: Access to pharmacies and prescription medication.

Additional Features and Services

Cigna Global Health Insurance offers additional features and services, including:

- Wellness programs: Access to wellness programs, such as fitness and nutrition advice.

- Health monitoring: Regular health monitoring and check-ups.

- Travel assistance: Assistance with travel arrangements and documentation.

FAQs

What is the maximum age limit for Cigna Global Health Insurance?

+

The maximum age limit for Cigna Global Health Insurance varies depending on the plan. Generally, it is 65 years old, but some plans may have a higher or lower age limit.

Can I customize my Cigna Global Health Insurance plan?

+

Yes, Cigna Global Health Insurance offers flexible plan options, allowing you to customize your coverage to suit your needs.

How do I submit a claim with Cigna Global Health Insurance?

+

You can submit a claim online, by phone, or by mail. You will need to provide supporting documentation, such as medical bills and receipts.

In conclusion, Cigna Global Health Insurance offers a range of benefits and plan options to suit diverse needs. While the cost may vary depending on individual circumstances, the comprehensive coverage and global network make it an attractive option for those who require international health insurance. By understanding the cost and benefits, you can make an informed decision about your health coverage and enjoy peace of mind while living, working, or traveling abroad.

Related Terms:

- Australia health insurance for foreigners

- Provider Cigna Envoy

- Cigna Global maternity policy

- Cigna Indonesia

- Cigna expat health insurance reviews

- Cigna health insurance